21 nov

Ding-Ding-Ding, NewsWala aa gya! Ye lo aaj ki taaza khabre!

| Today, in the NewsWala’s basket are:

|

And do not forget to check the winter hair guide for men! 🦸♂️

Chalo chalein!

MARKETS

| 19,694 | -0.19% | |

| 65,655 | -0.21% | |

| 43,584 | +0.0% | |

| 31,01,516 | -0.47% | |

| 310.70 | +5.32% |

Markets: BankNifty continued its rollercoaster ride in the day and closed with just 1 point difference. Other indices have closed in red mostly amidst waves of a bull run!

BUSINESS

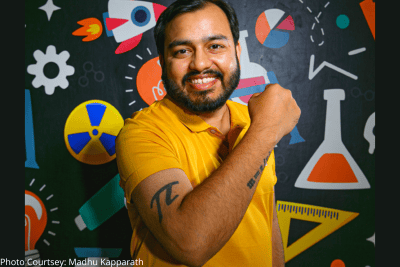

PW Fires 120 Workers After A Performance Review

What happened

Edtech unicorn Physicswallah, riding high on its unicorn status achieved last year, has made headlines with its first-ever layoffs. Around 120 employees faced the chop after a performance review cycle ending in October. The move was prompted by a cost-cutting initiative within the company.

Why it matters

This move by PW follows a broader trend in the Indian ed-tech sector, with giants like Byju’s, Unacademy, Vedantu, Cuemath, and Teachmint letting go of over 10,000 employees in the past two years due to a prolonged funding winter.

Despite the layoffs, Physicswallah reported impressive financials, boasting a 10x growth in operating revenue in FY22, reaching Rs

232.5 crore, and a substantial profit of nearly Rs 100 crore.The company aims for even grander figures in FY23, projecting

revenue to surpass Rs 1,200 crore with an EBITDA margin of 40-45%.

EBITDA margin is a measure of a company's profitability, showing the percentage of revenue that turns into earnings before interest, taxes, depreciation, and amortization.

Zoom out

While Physicswallah undergoes its first round of layoffs, it remains optimistic about its growth trajectory.

The company, founded in 2020, had secured $100 million in funding last year, elevating its valuation to $1.1 billion.

Despite the recent cuts, PW expressed plans to hire 1,000 additional employees in the next six months, emphasizing a commitment to growth and a high-performing team.

As the ed-tech landscape evolves, PW's strategic moves will be closely watched in an industry navigating challenges and opportunities.

BIG MONEY MOVES

Blue Dart And India Post Make A Collab

Blue Dart Express Limited has teamed up with India Post to introduce automated digital parcel lockers at selected post offices. This innovative collaboration allows consignees to retrieve shipments conveniently from secure lockers, eliminating the need for personal receipts or signatures. This strategic partnership aims to redefine efficient and reliable logistics solutions, enhancing last-mile delivery efficiency in an increasingly digital world.

Oberoi Realty's Grand Entry Into Delhi

Luxury real estate player Oberoi Realty has made a splash in the Delhi-NCR property market by acquiring nearly 15 acres of prime land in Gurugram for a whopping Rs 597 crore. The Mumbai-based company sealed the deal with Ireo Residences Company Pvt Ltd and others for the expansive land at Sector 58, Gurugram, Haryana.

BUSINESS

Retail Giants Target Value-Fashion Boom in India

What happened

In a strategic move, major retailers in India are doubling down on their expansion into the value-fashion sector. Fueled by rising disposable incomes and heightened consumer aspirations in smaller cities, the demand for budget-friendly branded apparel and footwear is soaring. Trent Ltd.'s Zudio, a triumphant player in this space, has become a role model for others, triggering a wave of emulation.

According to analysts, the value-apparel segment is set to experience a 6% Compound Annual Growth Rate (CAGR) from 2020 to 2025. However, the organized sub-sector is predicted to outshine this, boasting an impressive 13% CAGR.

Why it matters

The surge in the value apparel sector, valued at ₹2.5 trillion as of CY20 (constituting 57% of the total apparel market), is a direct result of increasing disposable incomes, demographic shifts favoring a youthful consumer base, and the ongoing trend of urbanization.

The growth of the value-fashion segment, with a projected 13% CAGR in the organized sub-sector, is injecting a significant economic boost. This expansion translates into increased revenue, job creation, and a positive ripple effect on related industries.

Beyond the metros and tier 1 cities, a massive opportunity beckons, driven by improved demographics, higher incomes, and heightened customer aspirations. This shift has enticed major players, including Yousta (Reliance Retail), Style-Up (ABFRL), and InTune (Shoppers Stop), to enter a market that was once dominated by regional and local operators.

Zoom out

Zudio has emerged as a frontrunner in this space, boasting over 350 standalone stores and a staggering revenue of ₹3,540 crore since its inception in FY17. Operating on a franchise-owned, company-operated model, Zudio's success lies in its high-fashion, low-price-point approach tailored for the youth segment. This has set the stage for intense competition with regional retailers such as V-Mart, Style Bazaar, City Kart, and V2 Retail.

BIG PICTURE

The END of the European petrochemical industry has begun

Europe's petrochemical industry is facing a crisis, with naphtha consumption hitting a 48-year low. High natural gas prices make it cheaper to import plastics, resulting in a 40% drop in naphtha usage. Steam crackers, crucial for production, are operating at uneconomical rates. Industry executives predict closures in 2024. European companies are shifting investments to Asia, causing the chemical trade balance to shrink from $40 billion to $2.5 billion.

Xiaomi roars back with first revenue gain in two years

Xiaomi celebrates its first revenue gain in nearly two years, reporting sales of 70.9 billion yuan ($9.9 billion) for the September quarter, surpassing estimates. The smartphone giant, rebounding from a challenging period, sees potential in its well-received Xiaomi 14 phones and the electric vehicle market. Xiaomi's stock has surged by $19 billion since June, reflecting investor optimism about its latest innovations and future ventures.

BUSINESS

L&T strikes gold in the Middle East

What happened

Larsen & Toubro (L&T) has hit the jackpot in the business world by snagging a mega offshore order from a prestigious Middle Eastern client. The company's Hydrocarbon business arm, also known as L&T Energy Hydrocarbon (LTEH), received a Letter of Intent for a massive project. The scope of work includes engineering, procurement, construction, and installation of a new offshore platform. Plus, they're throwing in some brownfield work, integrating it seamlessly with existing facilities.

Why it matters

This isn't just another day at the office for L&T; it's a financial slam dunk. The mega order, ranging between Rs 10,000 crore and Rs 15,000 crore, isn't just a feather in their cap—it's a peacock strut.

The $23 billion Indian multinational, is flexing its muscles in the EPC projects, Hi-Tech Manufacturing, and Services game, operating in over 50 countries worldwide.

Also, the company had recently secured significant orders for its water and effluent treatment business, proving that they're not just a one-trick pony. The management is so bullish that they're eyeing an outperformance of their FY24 guidance on order inflow and revenue growth.

Zoom out

L&T’s good days are back after it was recently fined a whopping ₹239 crore from the Qatar Tax Authority. The shares might be trading slightly lower today, but with moves like these, the market is sure to turn its gaze back towards this powerhouse.

MIRCH MASALA

👩🎤 Shakira's 7 million euro Tax Fraud Settlement Rocks Spain's Courts

🔝 Embrace change with confidence: Your guide to personal transformation

🤔 Are mutual funds ready to embrace New-Age Startups?

☀️ Read: Mars takes a two-week break behind the sun

🥶 Cold Snap, Hot Fixes: Men's winter hair Guide