Jan 24

Namaste! Aaj ka news roundup, Newswala style!

| Today, Your Newswala Delivers:

|

And also find out the Up’s ‘no helmet, no fuel’ policy hit by biker’s genius hack!

Chalo chalein!

Today’s reading time is 5 minutes.

MARKETS

| 23,205.35 | 0.22% | |

| 76,520.38 | 0.15% | |

| 48,589.00 | 0.28% | |

| 22,625.85 | 0.11% | |

| ₹89,51,542.30 | 0.33% |

Markets: Uncertainty remains over whether trade tariff measures will impact global trade, raise inflation, or cause currency volatility. The trend has been declining year-to-date, with a pause today as everyone waits for the upcoming 2025 budget.

TOP STORIES

How Tata Motors Plans to Stay Ahead

What Happened

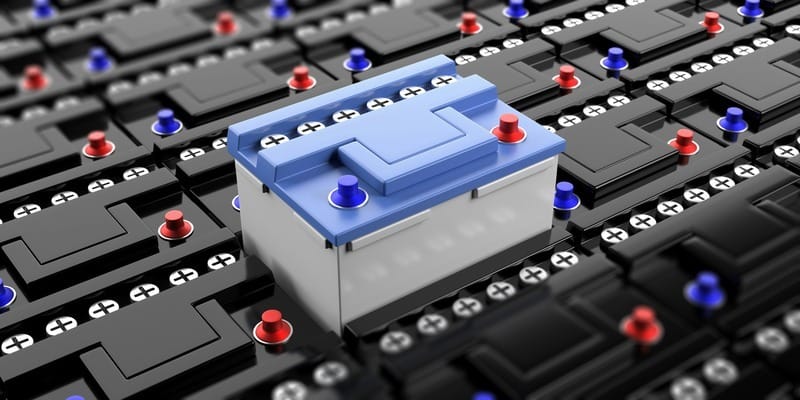

Tata Motors, India’s largest EV maker, is gearing up to dominate the competition with a $1.5 billion investment in a local battery gigafactory, slated to begin production in 2026. This move aims to streamline its supply chain and tackle rising competition from Mahindra, Hyundai, and Maruti Suzuki, with Tesla waiting in the wings.

Tata’s EV market share slipped to 62% in 2024 (from 73% in 2023), making this initiative crucial.

Why It Matters

India’s EV market is accelerating, with sales doubling from 100,000 in 2024 to an expected 200,000 in 2025. EVs now make up just 2.5% of India’s 4.3 million car sales, but their 20% growth easily outpaces the market’s overall 5% rise.

By producing lithium-ion batteries locally, Tata Motors gains control over the most expensive EV component, which competitors like Mahindra and Maruti lack.

Zoom out

The gigafactory in Gujarat will hit “full blast” by 2028, ensuring Tata stays ahead of the pack. The company aims to make 30% of its car sales electric by 2030, Tata is also cutting costs through its integrated supply chain and incentives worth $750 million from the government’s EV program.

PAISON KA KHEL

Dalmia Bharat Builds Big with ₹1,000 Crore Q4 Capex

Dalmia Bharat is pouring ₹1,000 crore into capital expenditure this quarter, taking its total spend for FY25 to ₹3,000 crore. The cement giant, already producing 46.6 million tonnes annually, plans to hit 49.5 million tonnes by March and aims for a whopping 75 million tonnes in the next expansion phase.

While India’s cement demand surges with government-led infrastructure projects, competitive heat may keep prices from climbing too high.

Kotak Bags ₹3,300-Crore Loan Treasure!

Kotak Mahindra Bank just went shopping and grabbed Standard Chartered Bank’s ₹3,300-crore personal loan portfolio. After getting the green light from regulators, the deal—first announced in October—was sealed on January 23, 2025.

This haul includes all the good loans (yes, the ones that pay back!). As for Kotak’s shares? They took a small 1.88% dip, closing at ₹1,894.60.

TOP STORIES

Zomato and Swiggy’s Private Labels Under Fire

What Happened?

The restaurant industry has called out Zomato and Swiggy for what they term “unfair competition.” At an NRAI town hall, restaurateurs accused the food delivery giants of using private labels—Zomato’s Bistro and Swiggy’s Snacc—to grab market share.

These labels offer food cooked in third-party kitchens at competitive prices, allegedly using insights from restaurant data. The icing on this slightly bitter cake is that Zomato and Swiggy have entered the dining-in space, charging restaurants a 3-5% commission for table reservations while luring customers with heavy discounts.

Why It Matters

Numbers don’t lie: restaurants say these practices are biting into their profits. For example, Impresario CEO Riyaaz Amlani noted that aggregator platforms account for 20% of dining-in traffic today, which could balloon to 40% within a year.

Meanwhile, Zomato and Swiggy’s private labels can undercut restaurant prices, thanks to lower operating costs. Sagar Daryani, NRAI president, pointed out the core issue: these platforms collect up to 25% in commissions for deliveries while using restaurant data to fuel their own ventures.

What’s cooking?

While customers enjoy cheaper options and more variety, restaurants fear losing control over their diners. Will ONDC and other platforms provide the industry with a slice of hope? For now, restaurants are fighting back with creativity—and maybe better deals for diners who book directly.

GLOBAL NAZARA

Ally Says Goodbye to Credit Cards

Ally Financial is bidding adieu to its credit card business, selling a $2.3 billion loan portfolio to CardWorks. Just three years after entering the game, Ally’s stepped back to focus on its “core businesses” like dealer financial services and deposits.

Interestingly, Ally once tried to buy CardWorks in 2020 for $2.65 billion—pandemic drama halted that. Now, the tables have turned! Most Ally employees tied to the credit card unit will join CardWorks, whose CEO called the deal a “natural fit.

$121 Million Bet on Indonesian Oil Block

Bharat Petroleum Corp (BPCL) is investing a hefty $121 million in Indonesia’s Nunukan oil and gas block, where its exploration unit, Bharat PetroResources, owns a 16.23% stake. The project, operated by Indonesia’s Pertamina, is awaiting regulatory approval.

BPCL reported a 37% profit surge in Q3, hitting ₹46.5 billion, despite LPG losses of ₹72.29 billion.

TOP STORIES

India Oil Buyers Scramble as Russian Shipments Dry Up

What Happened

Indian oil refiners are urgently looking for alternatives to Russian crude oil after facing the latest round of sanctions from Washington. The sanctions have thrown a wrench into India’s growing reliance on Russian shipments, which had accounted for about a third of the nation’s total imports

Why it matters

As a result, Indian buyers are turning to the spot market and negotiating long-term deals with Middle Eastern suppliers like Saudi Arabia and Abu Dhabi. Recent spot tenders have seen oil sourced from the Middle East, Africa, and even the US. The urgency is clear, with some shipments expected to arrive as early as February.

This shift comes at a time when Indian officials were confident that Russian crude would continue to flow despite sanctions, thanks to Moscow’s “dark fleet” of tankers. However, refiners are now feeling the pressure to replace up to 1.8 million barrels per day of Russian oil.

Wait, there’s more

The fear of running into trouble with international sanctions is making talks with OPEC producers a bit tense. These producers, once ignored for cheap Russian oil, are now back in the spotlight. With India’s energy needs still high, securing a steady flow of oil is crucial, especially as big names like Aramco re-enter the scene.

MIRCH MASALA

🐶 AI pets helping China’s Gen Z beat social anxiety

💤 The land where napping is the new tourism

🏆 And the nominees are: Priyanka Chopra’s Anuja & other top contenders (check full list)

💃 Kailash Kher band member dances to Air India’s anthem

❤️🩹 Doctors reveal the secret behind Saif Ali Khan’s miraculous recovery